5+ Superannuation Late Payment

Yes No You have up to four years from the date the original superannuation. Late payment of super can lead to penalties equal to 200 of the amount of superannuation payable.

13 Faqs On Gratuity Benefit Tax Implications Rs 20 Lakh New Limit

You have incorrectly calculated the amount of.

. Late super payments set to catch out Aussie employers this year. See our Super Sort-out page or call us on 1800 222 071 between 8am and 8pm AESTAEDT. If you miss a payment or it clears into the fund late the first thing you need to do is prepare or have your bookkeeper or tax agent prepare a Superannuation Guarantee Charge.

40150 600 39550 Imogen pays the. It is a legal requirement that superannuation for eligible employees be paid 28 days after the end of each quarter to their nominated superannuation fund. As of 1 July 2021 the super guarantee rate has increased to 10.

3000 105 315 Peter contributes 315 for the July to September quarter to Sues super fund by the quarterly due. There are no extensions available for these payments. Massive penalties apply for paying superannuation late.

As an employer you must make super payments for those employed under you into their nominated super fund. If youre an employer 2020 is the year you need to make sure youre paying superannuation entitlements. Think your super payments might be late.

The director of a company that fails to meet an SGC liability in full by the due date automatically becomes personally liable for a penalty equal to the unpaid amount 5. Using the late payment offset Imogen subtracts the administration fee from the super guarantee charge as follows. Made the payment to your employees super fund.

Ive missed a super payment. Superannuation Guarantee Quarter 2 Late Payments Due and New 2022 Threshold Removal Employers Are you late paying your compulsory SGC. The Australian Taxation Office ATO strictly enforce this policy.

From an AccountRight Pay Superannuation point of view if you do have to make an adjustment to the employees superannuation ie. When super is paid late even by 1 day -you need to prepare and submit a Superannuation Guarantee Charge form SGC within 1 month of the due date. Generally if you pay an.

Payment by due date and consequences for not paying on time. You can use a late payment to reduce the charge or as pre-payment of a future super contribution for the same employee. One day late is sufficient to remove deductibility so for example if payment is made after the close of business on the 28th day after the end of the quarter or month then no.

If it is paid late you must lodge a Superannuation Guarantee Charge SGC statement with the correct superannuation amount. You need to complete the Late payment offset election NAT 14899. If payment is late under the SGC the shortfall 95 superannuation payment reverts to being payable on all wages.

The minimum super contribution for Sue for the pay period is. Your SGC is calculated based on how. Late payment of super can lead to penalties equal to 200 of the amount of superannuation payable.

Late Super Payment Offset. Late payment penalties include. Late payment election for this employee.

If you have missed the quarterly payment due date or made late super payments you will need to lodge a superannuation guarantee charge SGC statement and pay the SGC to us. Paying 95 superannuation on all wages not just ordinary earnings. In most cases you can offset late payment amounts against the SGC if you.

This pre-payment is tax-deductible in the normal way.

Late Superannuation Payments Can Be Costly And The Ato Now Has Real Time Access To Your Mistakes Pitcher Partners

20 000 Qantas Points For Joining Australian Super Ozbargain

4 Questions We Hear About Late Superannuation Payments Link Advisors

Late Payment Stock Illustrations 565 Late Payment Stock Illustrations Vectors Clipart Dreamstime

What Are The Penalties For Late Super Payments Even If 1 Day Late Youtube

What Is Superannuation Benefit In India And How It Is Taxed Basunivesh

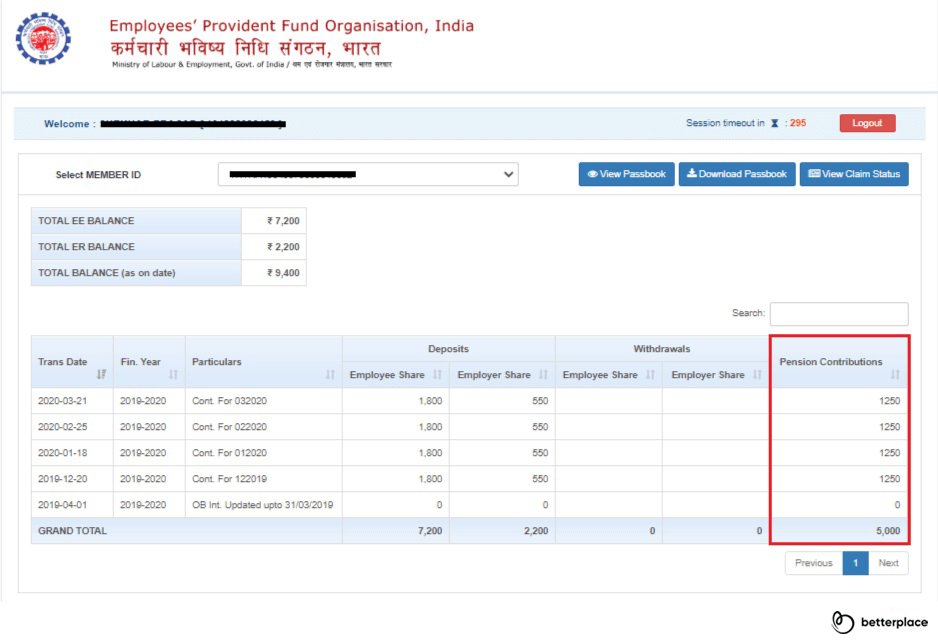

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

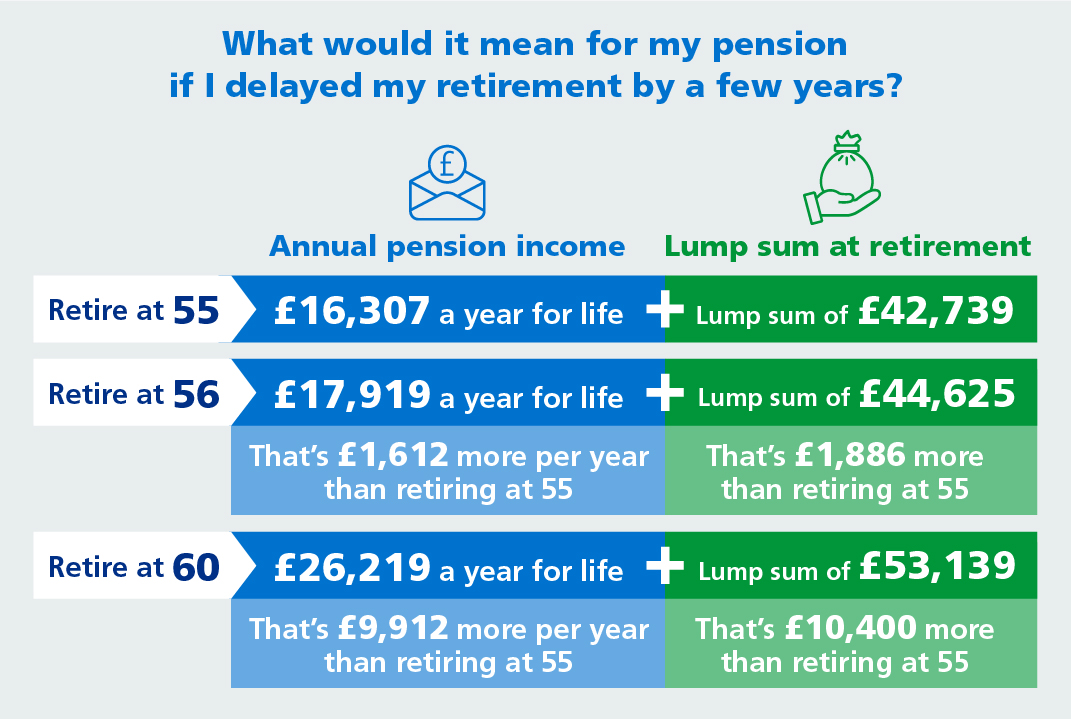

Nhs England Delayed Retirement 1 And 5 Years

Massive Penalties Apply For Paying Superannuation Late Nexia Edwards Marshall Nt

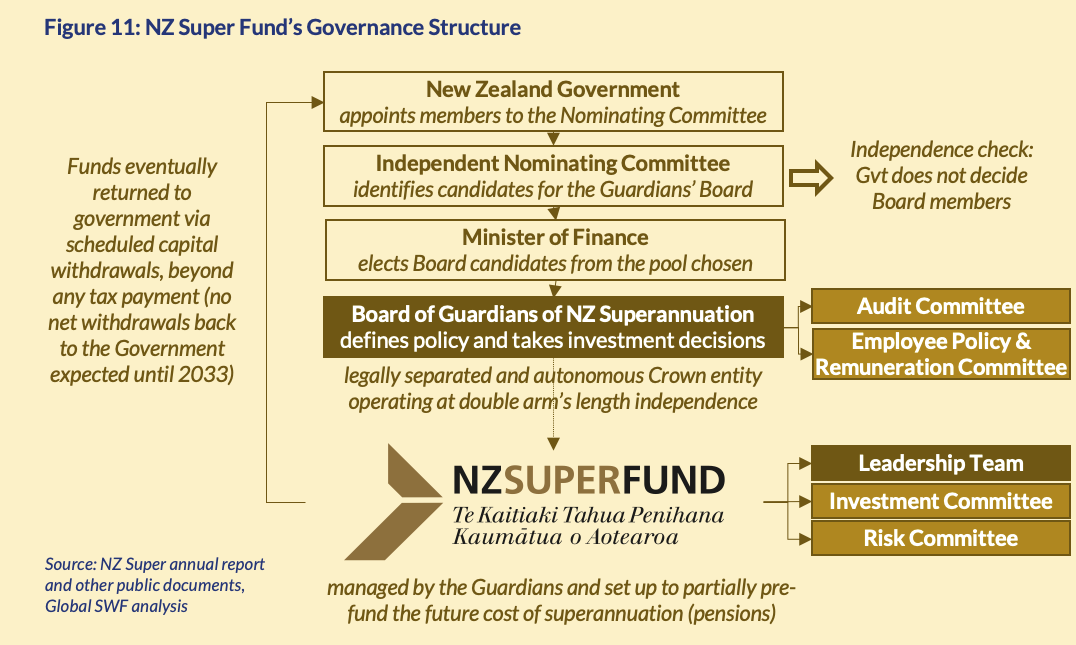

Global Swf

Will I Get Form 16 For A 5 Month Salary Quora

Global Swf

Ato Focus On Late Super Payments Matched Through Stp

Penalties For Late Superannuation Payments And Not Paying Super Twusuper

What Happens If I Pay An Employee S Super Late Ctbs

Open Esds

2015 University Of Wollonong Annual Report By University Of Wollongong Issuu